Another important aspect refers to the fact that the Labuan jurisdiction is a very welcoming region for foreign investors as they are allowed to incorporate a company. Labuan non-trading activity means an activity relating to the holding of investments in securities stocks shares loans deposits or any other properties situated in Labuan by a Labuan entity on its own behalf.

Labuan Business Activity Tax Act 1990 Act 445 Labuan Ibfc Flip Ebook Pages 1 18 Anyflip Anyflip

- more than 50 banks and over 200 foundations operate there.

Example of labuan business activity. Labuan business activity means a Labuan trading or a Labuan non-trading activity carried on in from or through Labuan excluding any activity which is an offence under any written law. Sample 1 Sample 2. Labuan entity means an entity which is created incorporated licensed or registered as the case may be under any of the following Acts.

A Labuan insurance company includes Labuan Insurer Life and non-life Labuan Professional Reinsurer Life and Non-Life and Captive Insurer. The Regulations specify that a Labuan entity carrying on a Labuan business activity must establish an office in Labuan with a minimum of two to four full-time employees and have an annual operating expenditure in Labuan in the range of MYR50000 to MYR3 million depending on the type of business. For example a Labuan bank investment bank Islamic bank or Islamic investment bank must have a minimum of three full-time employees in Labuan.

Labuan Trading Company defined the trading activity that includes import export trading consultancy management shipping financial services banking insurance or any other business activity other than non-trading activity. These companies may transact general insurance business or life insurance business whether as direct business or as reinsurance. Under the Labuan Business Activity Tax Act 1990 Labuan Trading Company only pay a 3 tax on net profit based on the audited report.

Sample 1 Based on 1 documents. Labuan Taxable Activities Taxation With effect from 1 Jan 2019 under Labuan Business Activity Tax Requirements for Labuan Business Activity Regulation 2018 a Labuan company carrying on a Labuan business activity is only subject to tax at the rate of 3 of net profit PROVIDED that it has fulfilled the requirement of the. Labuan trading activity Includes banking insurance trading management shipping operations licensing or any other activity which is not a Labuan non-trading activity.

- there are about 400 leasing companies and. Labuan trading activity includes banking insurance trading management licensing shipping operations or any other activity which is not a Labuan non-trading activity Labuan non-trading activity means an activity relating to the holding of investments in securities stocks shares loans deposits or any other properties situated in Labuan by a Labuan entity on its own behalf. Labuan business activity means a Labuan trading or a Labuan non-trading activity carried on in from or through Labuan in a currency other than Malaysian currency by a Labuan entity with non-resident or with another Labuan entity.

LEGAL PROVISIONS OF INTEREST TO LABUAN INSURANCE COMPANY. For example these are required for banking insurance fund management company management leasing and other financial activities. Broadening the scope of Labuan business activity to include shipping operations.

- More than 14000 companies are incorporated in Labuan. The figures below give a picture of the existing business environment according to the year 2018. Labuan Companies Act 1990 Removal of the requirement to obtain approval for dealings between Malaysian residents and Labuan companies.

For example Labuan companies are limited in terms of trading with Malaysian companies or residents. For example a Labuan bank investment bank. Labuan Business Activity Tax Requirements for Labuan Business Activity Regulations 2018 The above Regulation was issued on 31 Dec 2018 and effective from 1 Jan 2019 that.

Trust Companies and Ancillary Services. 3 of net profits per audited accounts. Carrying out both Labuan trading and non-trading activities - Deemed to be Labuan trading activity.

Following are different types of business activities 1 Budgeting. The list of special permits can also extend beyond the financial sector and our Labuan offshore company specialists. Labuan IBFC and to ensure consistency with other legislation relating to Labuans financial services.

Labuan trading activity includes banking insurance trading management licensing shipping operations or any other activity which is not a Labuan non-trading activity. There are different types of business activities based on the nature and requirement of the business. The Regulations specify that a Labuan entity carrying on a Labuan business activity must establish an office in Labuan with a minimum of two to four full-time employees and have an annual operating expenditure in Labuan in the range of MYR50000 to MYR3 million depending on the type of business.

Labuan International Business Capital Gains Tax Tax Refund

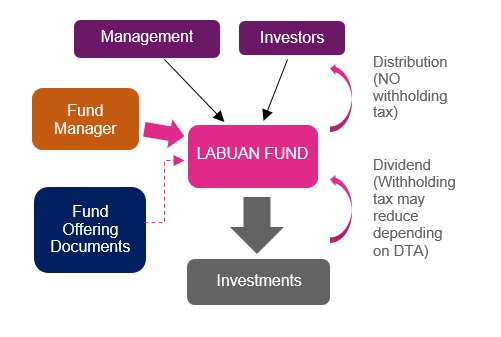

Labuan Mutual Fund Jtc Kensington