Do you know anything about MM2H visa. To date 11 countries have specifically excluded Labuan entities from accessing treaty benefits in their double tax agreements with Malaysia.

Expat Secrets How To Pay Zero Taxes Live Overseas Make Giant Piles Of Money In 2021 Expat Business Class Travel Overseas

Resident companies in Labuan are subjected to a Corporate Income Tax rate of 3 on annual audited taxable net income under Labuans Tax Regulations.

Labuan corporate income tax. All individual foreigners earning salaries fee bonuses in Malaysia are subject to personal tax. The current corporate tax rate is. Corporate tax Non-Licensed entity 24 local tax You can check here to see how to apply for work permit.

The corporate income tax is the main tax levied on companies incorporated in Labuan. Corporate tax was cut from 28 to 27 in 2007 to 26 in 2008 and to 25 in 2009. A non-resident company also pays 25 2013 on chargeable income.

Prior to 1 January 2008 Malaysia adopted the imputation system which required the imposition of tax on the profit at corporate level and again at shareholders level. Dividend received by the Shareholder of a Labuan company is Not taxable in Malaysia. Other income see PUA order 209 of 2012 Election to be subject to provisions of the Income Tax Act.

Labuan company that have opted to be taxed under the Malaysia Onshore Income Tax Act 1967 will follow the local corporate tax rate of 17 on the first RM 600000 followed by 24 on subsequent chargeable income. Dividend received by a Labuan company is Not subject to tax. Tax returns must be filed by 31 st March or a 10 penalty will be imposed on the outstanding balance.

Income Tax Exemption No22 Order 2007. On 23 December 2016 the Income Tax Country-by-Country Reporting Rules 2016 CbC Rules was gazetted in Malaysia. C For Dormant Company zero tax and no audit report d All Labuan companies can opt to have a Permanent Election to be taxed under Malaysia Local Tax ITA 1967.

The tax year is generally the same as the accounting year and companies must file the tax returns under a self-assessment. Fast Incorporation The general incorporation of a Labuan company only take 5-7 days and can be accomplished even if the foreign investors cannot be present in Labuan during the entire. The healdine rate of corporate tax in Malaysia is 25 2013.

MM2H application - Below 50 years old. The corporate income tax for a company in this special region is only 3 on your profit and in some cases companies are completely exempt from the profits tax. Technical services advice or assistance specified in section 4Ai and ii of the Income Tax Act and.

Under the newly enacted Labuan Business Activity Tax Amendment Act 2020 LBATA 2020 Amendment where Substance Requirements are not complied with effective from year of assessment 2020 the Labuan entity will be taxed at the rate of 24 on its net profits for that year of assessment. And for every additional RM 1 the rate is 24 Comparison of Income Earned by Expatriates under Labuan International Company and Malaysian Sdn Bhd Company as follows. Other taxes on companies levied in Malaysia include the capital duty tax the real property tax the payroll tax and the social security tax payable both by the employer and the employee.

Fixed deposit in Malaysian bank RM 300000. According to Section 41 of LBATA tax shall be charged at a rate of 3 a year on the net audited profits of a Labuan entity carrying on a trading activity. Labuan entities carrying on a Labuan trading activity no longer have the option to elect to pay tax of RM20000.

Labuan entities carrying on a Labuan business activity that is a Labuan trading activity generally are taxed at 3 of their net audited accounting profits chargeable profits under the Labuan Business Activity Tax Act 1990 LBATA. Offshore income RM 10000 month or more. Corporate tax Licensed entity 3 Labuan tax.

Liquid asset worth RM 500000 or more. Labuan Taxes are Easy Labuan holding company is subject to 0 tax zero tax Labuan licensed company is subject to 3 tax Malaysia Double Taxation Agreement DTA protects your income from being taxed twice. Although Labuan is a federal territory within Malaysia there are preferential tax treatments for companies conducting Labuan business activities such as low fixed tax rate of 3 withholding tax exemption on payments to non-residents tax exemption on fees paid to non- citizen directors and so on.

Income obtained from royalties and intellectual property received by a Labuan company is subject to 24 corporate tax rate. Subsequently on 26 December 2017 the Labuan Business Activity Tax Country-by-Country Reporting Regulations Labuan CbC Rules was also gazetted. These rules came into effect on 1 January 2017.

THE LABUAN TAX FRAMEWORK The tax laws relating to Labuan entities are set out in the Labuan Business Activity Tax Act 1990 LBATA. This means that all Labuan entities that carry on a Labuan trading activity and comply with the relevant economic substance requirements shall be subject to.

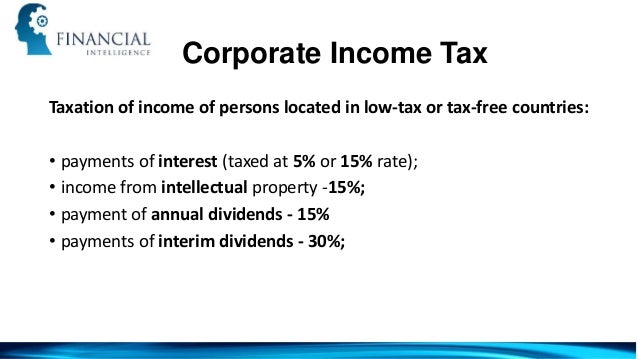

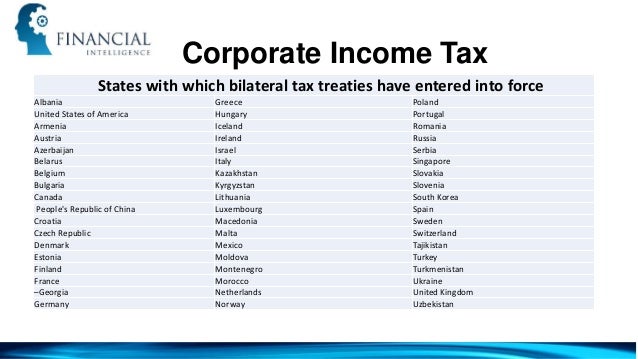

Corporate Income Tax In Latvia

Corporate Income Tax In Latvia