One either individual or corporate entity Residency requirements. By contrast non-resident directors of onshore Malaysian companies pay 26 personal income tax on directors fees.

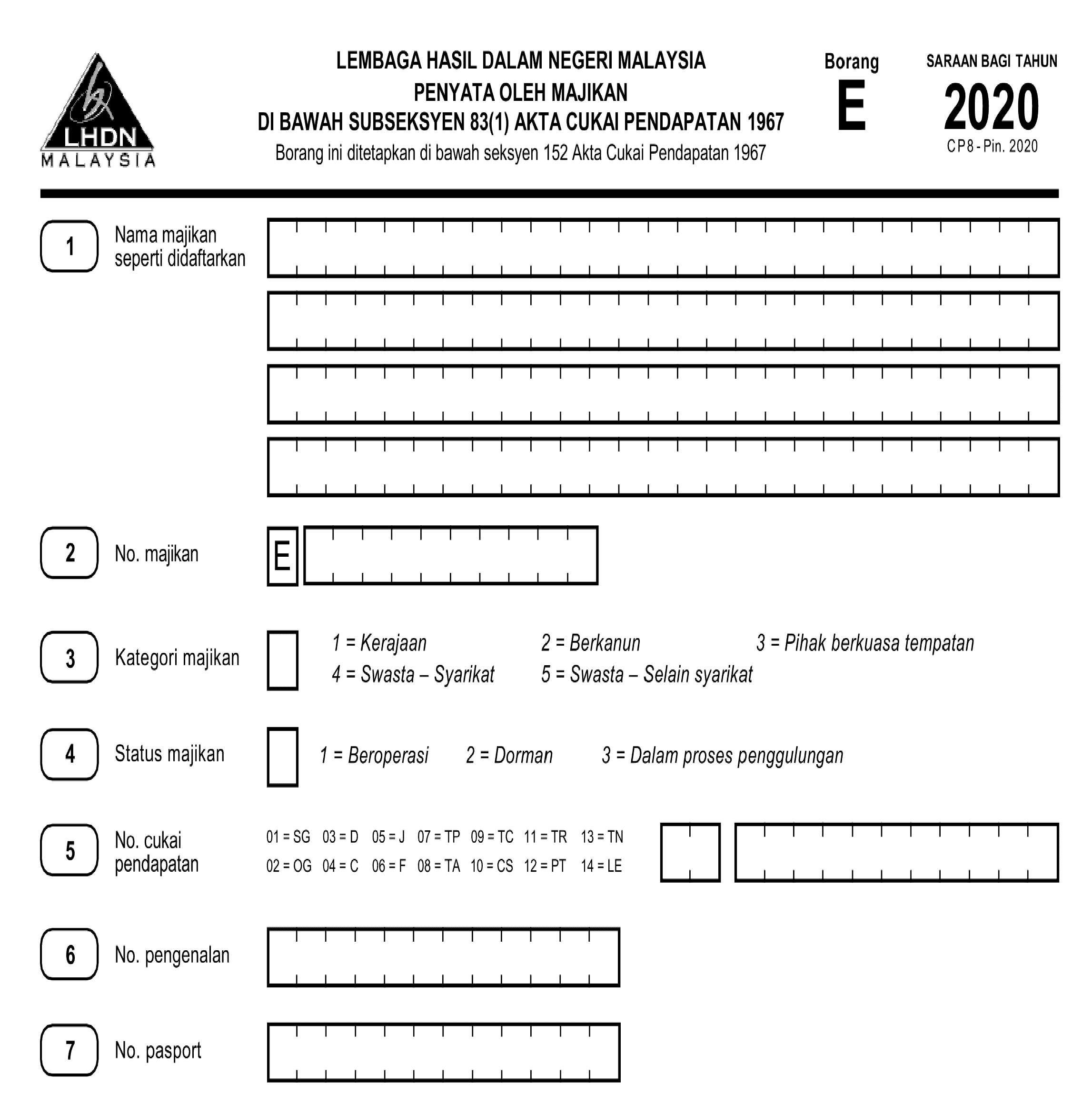

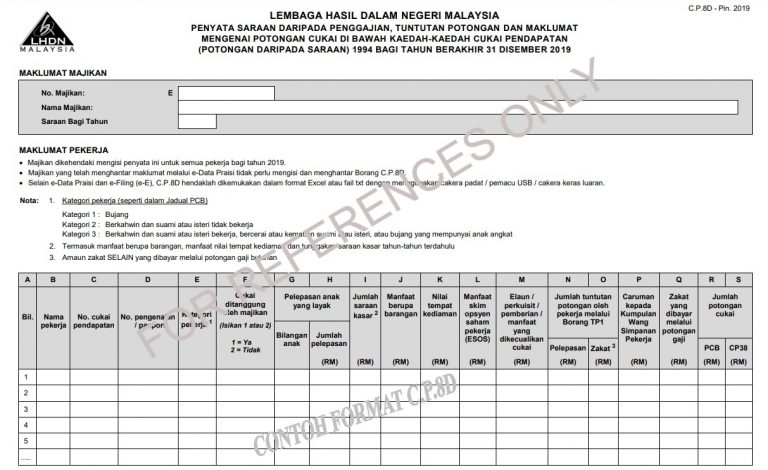

How To Use Lhdn E Filing Platform To File Borang E To Lhdn Clpc Group

Labuan Companies Act 1990 Removal of the requirement to obtain approval for dealings between Malaysian residents and Labuan companies.

Labuan directors fees on form be. Labuan-based companies can take advantage of Malaysias double tax avoidance treaties with 68 countries including Canada China India Singapore and the United States. Only an approved officer of a Labuan trust co or its wholly owned subsidiary may be appointed as a resident secretary. Location of directors and shareholders meeting Anywhere.

Non-Malaysian Citizen acting in the capacity of a director of a Labuan entity are exempted from payment of income tax in respect of directors fees received from YA 2007 until YA 2020. The application should be submitted together with the Memorandum and Articles of Association consent letter to act as director statutory declaration of compliance as well as payment of registration fees based on paid-up capital. Tax on Directors Remuneration.

Labuan International Company is permissible to deal with local Malaysian businesses. Taxpayers and everyone residing in countries who tax worldwide income must declare all income to their tax authority. Minimum Labuan staff.

Rules concerning Director Salary and Director fee. Directors fees are generally taxable as well but this applies only if the director has rendered the requisite services for the accounting year concerned. All directors and employees working at Labuan Company are required to submit a personal income tax return to the Internal Revenue Service IRB for salary income earned in the previous calendar year.

Incorporation of a Labuan company in Labuan IBFC must be done through a Labuan trust company. However It is mandatory for an employer to deduct tax on the director fees during the month of payment for the directors fees. Yes and if more than one is appointed at least one must be a resident secretary.

Directors salaries are taxable since such salaries are considered income derived from the directors employment. No Directors fees are assessed in the year that a director received the payments. Introduction of provisions for the creation of treasury shares and.

Any payment received from participating in the Malaysian Technical Co-operation Programme MTCP by a non-resident individual who is non-Malaysian citizen is exempted from tax with effect from YA 2007. Allow a Labuan company to issue shares which may be divided into one or more classes and also to issue fractions of its shares. Non-resident directors of a Labuan offshore business pay no personal income tax on directors fees.

Return on particulars and changes of directors and secretaries. All Labuan expatriates including directors holding work visas applied under their Labuan company will be assessed as salary payments. RM 1200 to RM 5200 depending on authorised capital.

Labuan Limited Company Formation and First-Year Fees- USD 430000 All Included Note that our incorporation and annual fees are all all-included fees and cover all the required services duties disbursements and procedures to incorporate a Labuan company and keep it in good standing excluding annual audited accounts if required. Labuan directors can also declare Directors fee which is not subjected to any income tax. The annual contribution cost on Labuan Island must be RM50000 or more including the annual company secretary expenses office expenses and salary payment to staff etc If the above requirements cannot be met the mainland Malaysia tax rate 24 will be applied.

Simple structure only needs one Director and. Labuan money broker is a forex broking business between buyers and sellers. Companies need not make CPF contributions on directors fees.

Labuan insurance broker is a person who arranges insurance business on behalf of policy owners. Labuan International Company. Labuan International Company for your International Trading Business.

Statutory declaration by a Labuan trust company as an agent of a foreign Labuan company. Registration of a foreign Labuan company. Fees received by an individual non-Malaysian citizen as a director of a Labuan entity are exempted from income tax from YA 2011 to YA 2020.

Resident director is optional. Yearly taxation on profit for Trading Company only 3. Minimum salary eligible for 2 years renewable work visa is RM10000.

RM 1500 for Labuan companies RM 5300 for foreign Labuan companies. No income tax for all directors fees and only 14 for all expatriate employee salaries. Thus if directors fees.

Minimum spending in Labuan. Memorandum and Articles of Association foreign Labuan company Nil. Kindly note that the deadline for.

And arrange reinsurance business on behalf of insurer. Public record of directors Shareholders No. Income Tax Exemption No8 Order 2011 PU A 4202011 50 of the gross employment income received by an individual non-Malaysian citizen in a managerial capacity with a Labuan entity in Labuan.

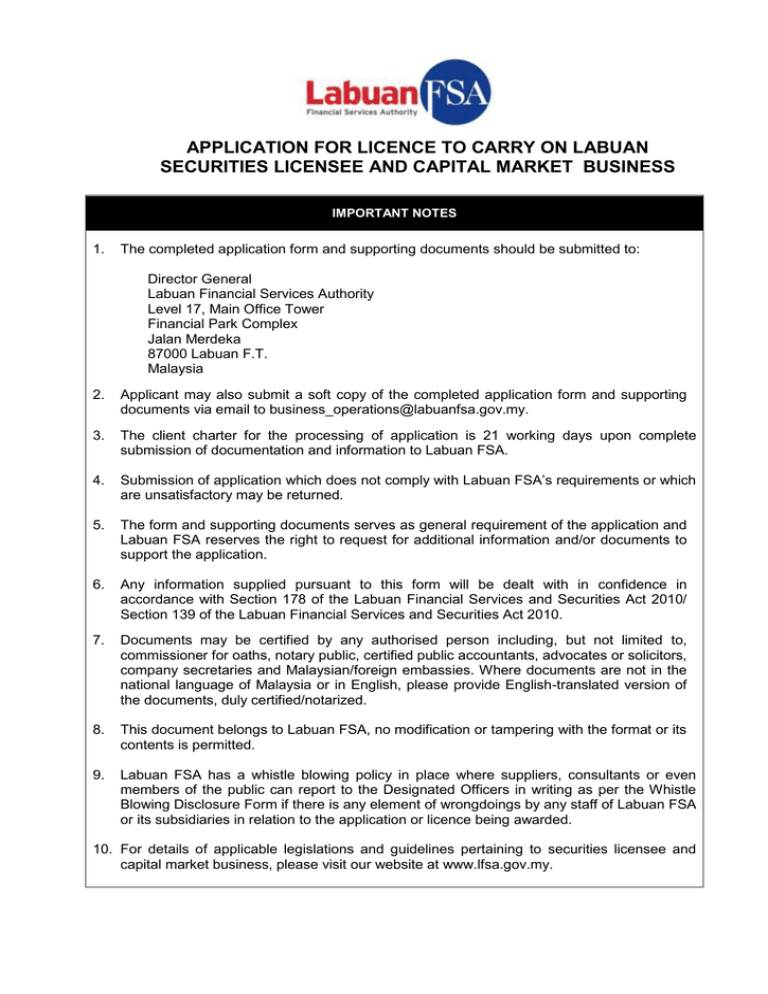

Form Lscm Labuan Securities Licensee Capital

Http Www Hasil Gov My Pdf Pdfborang Form Pt2018 2 Pdf