The Labuan Investment Committee announced on 11 December 2019 that it will expand the list of types of Labuan entities that are subject to the substance requirements to include entities that undertake pure equity holding activities and entities that carry on non-pure equity holding activities. No tax for investment holding company.

How To Set Up Malaysia Labuan Offshore Company The Best Entity

Must hire 1 labuan staff.

Investment holding company labuan. Labuan may be an offshore company in malaysia but it is still expected to comply with bank negara the labuan company. LIC Pronouncement 32020 has explained the differences between these two categories of Labuan entities. These Labuan Investment Holding Company Labuan IHC owners may hold access to the bank account of various foreign currencies.

These tax positions are enshrined in the LBATA and readily accessible. Investment Holding and Trading Company. The Labuan Offshore Jurisdiction has become one of the preferred jurisdictions in Asia for offshore company formation since the Malaysian government made it into an international offshore financial centre in 1989.

3 Corporate Tax. The formal name for an offshore company in Labuan is a Labuan International Business Company Labuan IBC. When the Labuan company trades on the Malaysian market the corporate income tax for trading activities is the usual 24.

No sales tax and service tax. One of the most renowned financial centers in Southeast Asia Complete exemption from income tax on profits for holding companies. Axiata Investments Labuan Ltd.

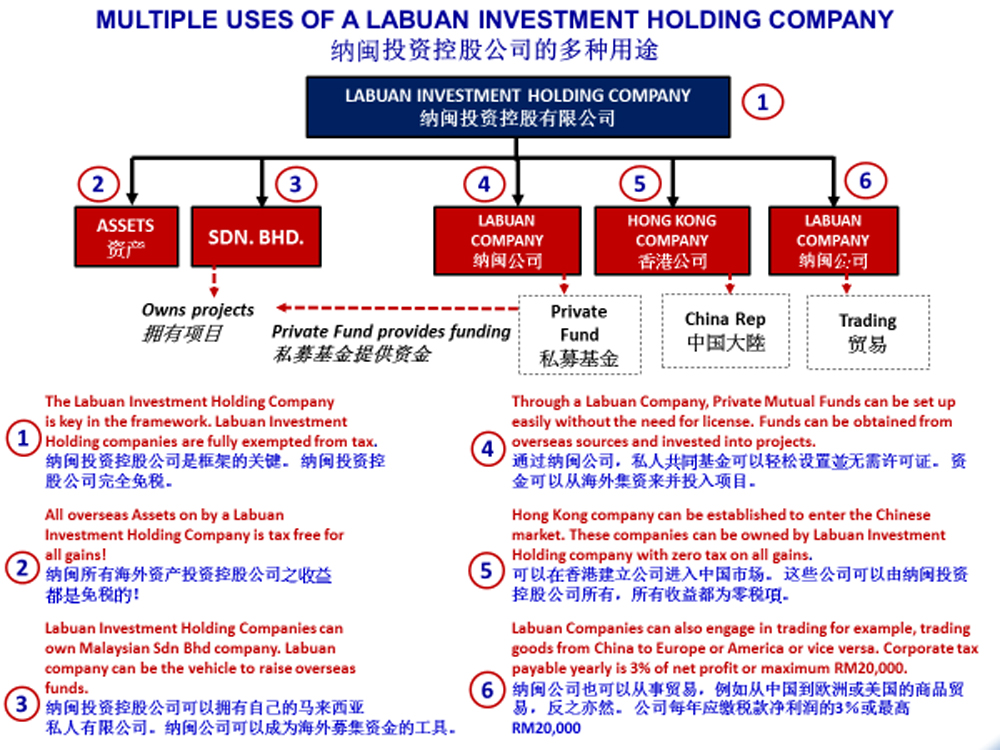

There are many ways a Labuan Company can be utilized as an investment vehicle. What is the difference between Labuan trading company and Labuan investment company. Since Labuan IHC diversifies the business it makes acquisition simpler and also allows the business owners to maintain ownership throughout the structure.

However no regulations amending PU. No withholding tax for Royalty interest income lease rental management fee. Ibh investment bank limited labuan investment bank licence no.

5 Main Uses Of Labuan Investment Holding Company Invest in digital currency trading fund and Blockchain funds. Banking Insurance Leasing GIFT Credit Token Money Brokering. No further submission to Inland Revenue Department and Labuan FSA is required.

An offshore company as the holding company opens up the opportunity for unlimited investment financing. No Property gain tax. Labuan Investment Holding Company.

These values apply when the company trades on the ASEAN market. Was incorporated on the 28 of March 2014 under the Labuan Offshore Financial Services Authority as a financial services investment and investment consultancy company. Payments of dividends interest service fees and royalties by the Labuan company to non-residents are also exempt from Malaysian withholding tax.

A Labuan holding company that derives its investment income from a non-trading activity is not subject to tax under LBATA. As stated above only pure equity holding companies are exempted from complying. No sales tax and service tax.

Labuan investment holding companies are divided into two 2 categories namely pure equity holding companies and non-pure equity holding companies. ADVANTAGES OF LABUAN OFFSHORE COMPANY. Set up time is only 2 weeks.

No GST or VAT. Invest in private equities such as Venture Capital companies that deal with Blockchain technology. Trading companies on the.

The Company through its subsidiaries provides data and voice communication services. No sales tax and service tax. An investment holding company is subject to zero tax in Labuan while a company involved in trading activities is subject to a profit tax of 3 or 20000 RMN.

Mahdi Holdings Investment Ltd. Labuan non-trading activity means an activity relating to the holding of investments in securities stocks shares loans deposits or any other properties situated in Labuan by a Labuan. Click here to understand what needed to be done for compliance of a Labuan dormant company.

Let us have a look at the tax profile of a Labuan investment. Investment companies are usually incorporated to hold assets or shares in companies that are located in other jurisdictions. The most attractive advantage of a Labuan investment holding company is the zero tax advantage and no audit reporting is required.

Invest in start-ups of Blockchain technology companies. Company Formation in Labuan Malaysia. Funds Foundation Trust Listing in Labuan Financial Exchange.

Investment holdings activities can be any combination of the followings. For a dormant company or investment holding Labuan business companies they only need to submit a management account report to us. INCORPORATION OF LABUAN COMPANY.

Invest in intellectual patents of. Axiata Investments Labuan Limited operates as a holding company. FUND WEALTH MANAGEMENT.

Guide to Start Labuan Investment Holding Company. Easy to open bank account. Make an enquiry today by call us at 6011-1299 7745.

Labuan Private Fund Registration

Eurasia Trust Ag Bonds Beyond Expectations